AI for C-level managers: hype or not?

In the past 2 years, ChatGPT and other generative AI solutions have sparked a revolution in the business world and beyond. Today, it would be challenging to find a business professional who hasn't heard of these tools, and fewer still who haven't experimented with them in their daily lives or work even unwillingly.

The rapid adoption of GenAI demonstrates the immense potential of generative AI technologies or the laziness of white-collar employees. Maybe both. Business leaders, entrepreneurs, and professionals across industries have recognized that this tool is not just a passing technological fad, but a real value-creating opportunity that could fundamentally change how we work in numerous sectors. Is it?

It is hard to separate the real value and hype factors of GenAI at a corporate level

A recent McKinsey study provides valuable insights into how CFOs and other responsibles can approach Gen AI both at the enterprise tier and within finance functions. C-level managers play a crucial role in identifying and allocating resources to the most valuable opportunities, regardless of whether they involve AI. It's not about the hype, it's about the revenue. Some things never change – the fundamental principles of finance and economics remain the same: companies must generate returns above their cost of capital.

Key points for CFOs:

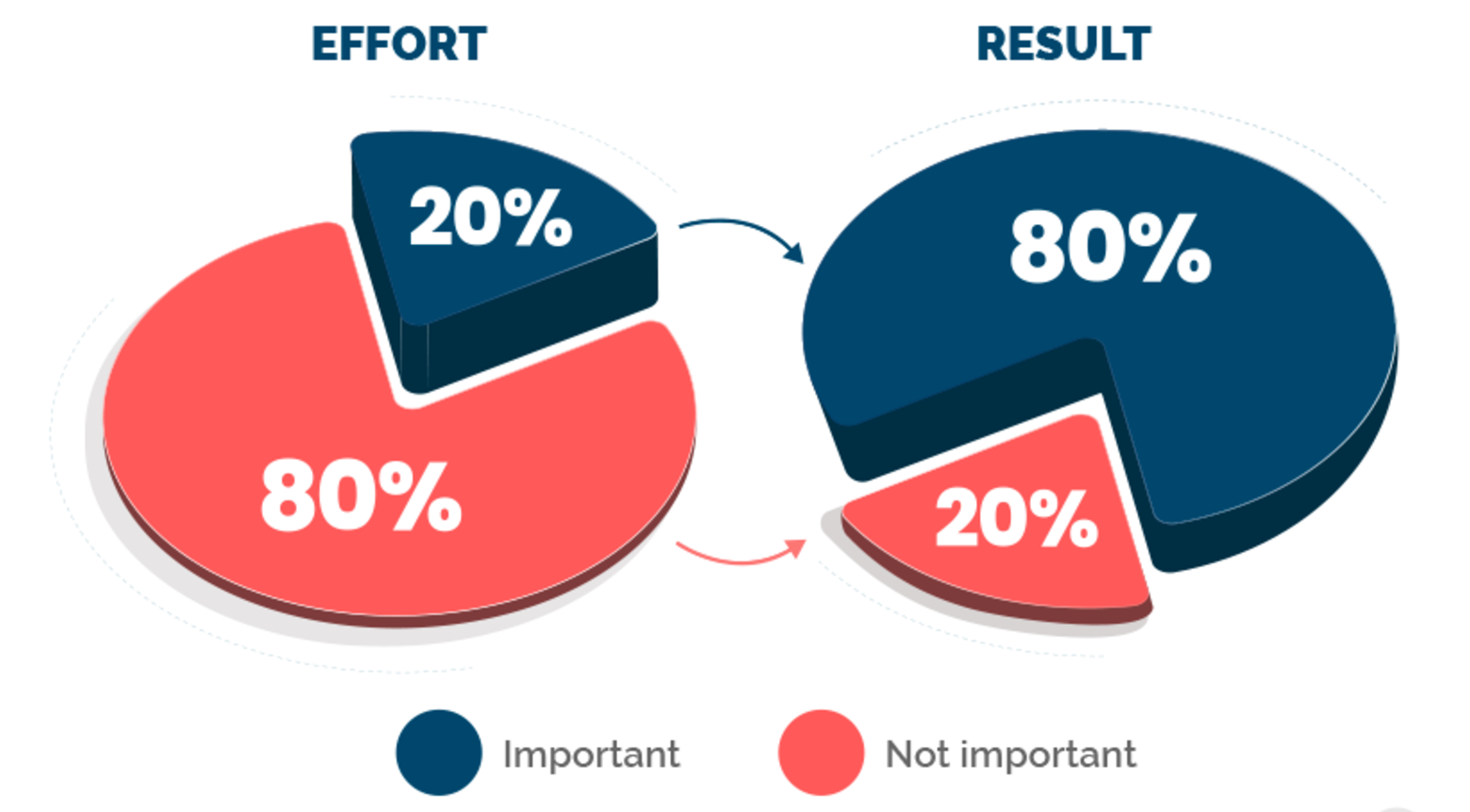

- Prioritize the top 20-30 value-creating projects across the organization.

- Recognize existential threats to the company's businesses.

- Understand the key drivers for generating and sustaining higher cash flows.

- Don't dismiss efficiency boost opportunities due to a lack of understanding or imagination.

Point #4 is easy to forget or overlook. Gen AI is set to become an essential tool for most finance functions, potentially saving significant time and resources. McKinsey's survey indicates that the majority of finance functions in large enterprises are likely to use Gen AI substantially within the next 3-5 years.

Let's Talk AI Strategy

Exploring how AI can create real value for your organisation? Get in touch to discuss your digital transformation journey and learn how we help EdTech companies navigate the AI landscape.

Analyzing the financial performance by maturity

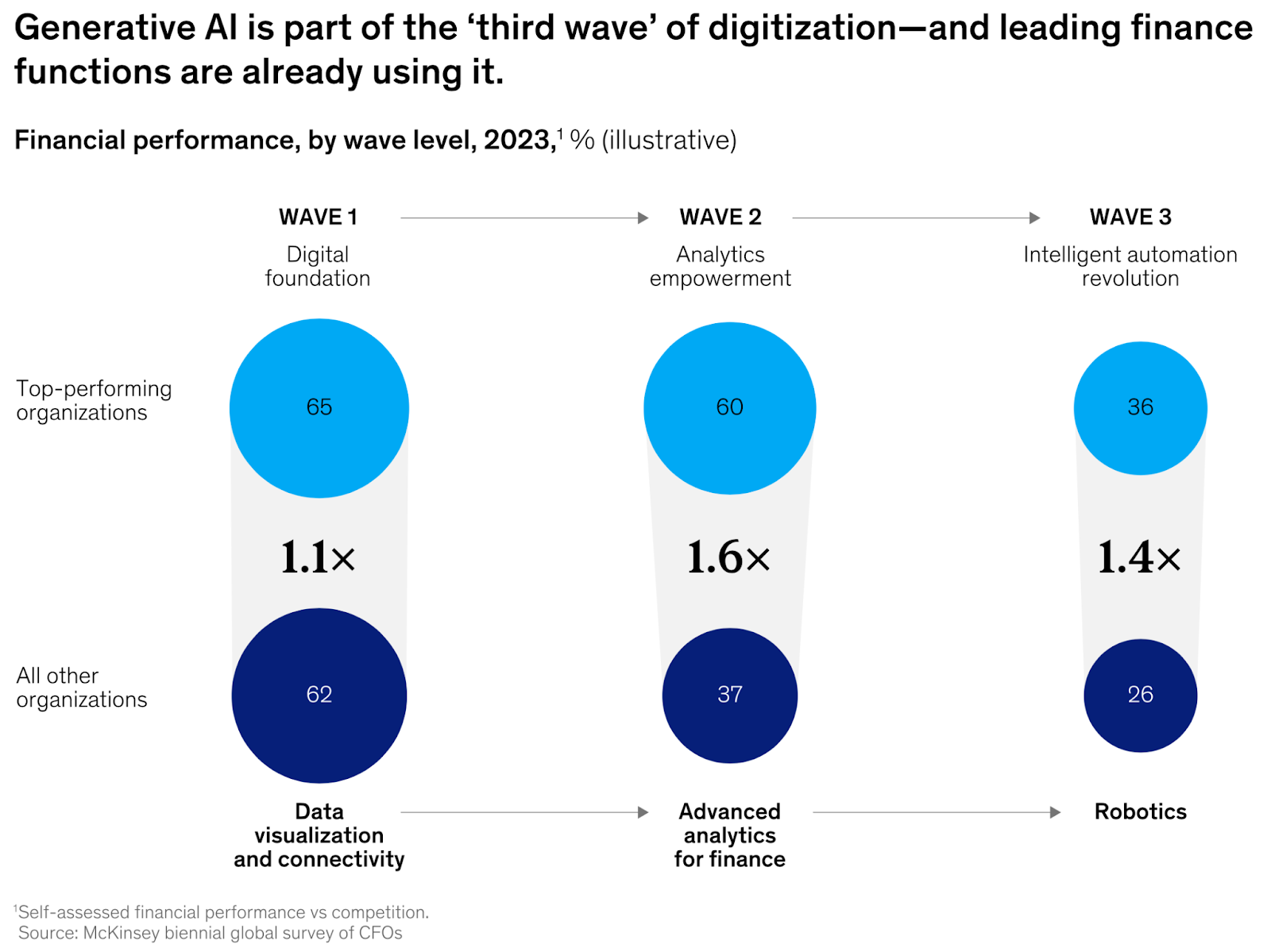

Wave 1: Digital foundation

The first wave (Figure 2) focuses on data visualization and connectivity, where top-performing organizations achieve a 65% performance rate compared to 62% for other organizations. This relatively small gap (1.1x difference) suggests that basic digital infrastructure has become widely adopted across the financial sector.

Strategic implications

The small performance gap highlights two critical points:

- Basic digital capabilities are now essential for survival rather than a source of competitive advantage, organizations must look beyond digitalization to differentiate themselves.

- The foundation must be solid before moving to more advanced waves.

Wave 2: Analytics empowerment

In the second wave, which centers on advanced analytics for finance, the performance gap widens significantly. Top performers achieve 60% performance while other organizations only reach 37%. This 1.6x difference indicates that advanced analytics capabilities have become a key differentiator in financial performance. Data analysis seems mandatory to remain a top participant in the race.

Wave 3: Intelligent automation revolution

The third wave, characterized by intelligent automation and robotics, shows a performance rate of 36% for top performers versus 26% for others. While the absolute numbers are lower due to the emerging nature of these technologies, the 1.4x performance difference demonstrates that early adopters of AI and automation are gaining competitive advantages.

It would be easy to choose Wave 3, "Okay, I want this", but the decreasing absolute percentages across waves reflect the increasing complexity and sophistication of each technological stage, while the performance gaps highlight how digital capabilities are becoming essential differentiators in financial success.

Gen AI can impact finance functions in three primary ways: automation (e.g. preparation of a draft material), augmentation (e.g. more productive work or work environment for people), and acceleration (e.g. knowledgebase, informational reporting). How should you start?

How to evolve?

Organizations looking to advance their AI capabilities have several strategic options:

1. Start small, think big

Build foundational capabilities first through pilot projects and targeted implementations, while maintaining a vision for broader transformation.

2. Focus on value creation

Select AI initiatives based on clear business value rather than technological novelty, prioritizing projects with measurable ROI.

3. Invest in people

Develop internal capabilities through training and upskilling programs to ensure staff can effectively utilize AI tools.

4. Build strategic partnerships

Collaborate with technology providers who understand both AI capabilities and industry-specific challenges. If you need assistance, we are here to help.